Group structure and shareholders

Group structure

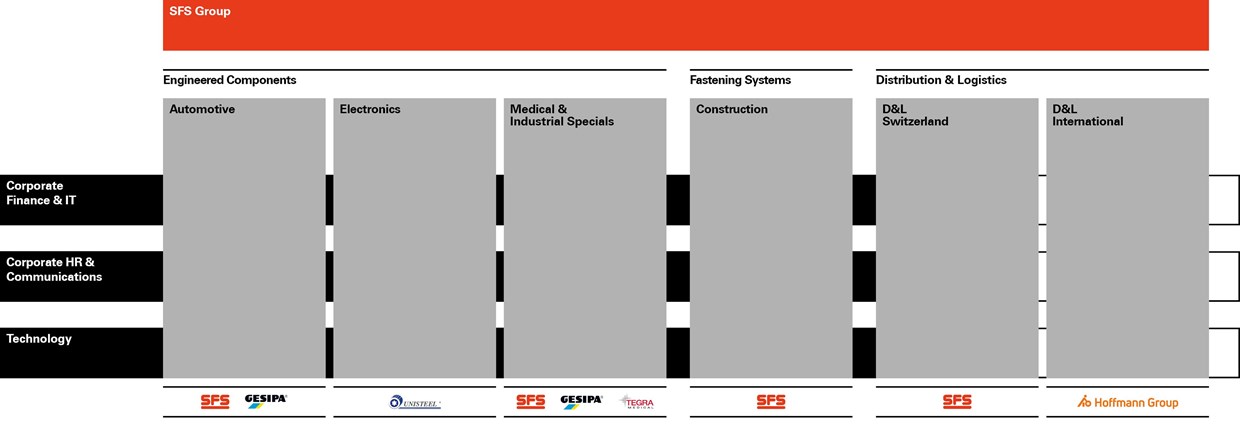

As of the end of 2024, the SFS Group is divided into the three segments Engineered Components (EC), Fastening Systems (FS) and Distribution & Logistics (D&L) as well as into six divisions.

As of January 1, 2024, the Industrial and Medical divisions (EC segment) were merged to form the Medical & Industrial Specials division. The Riveting division (FS segment) was also integrated into the Automotive and Medical & Industrial Specials divisions (EC segment) from the start of 2024. As a result, SFS Group AG comprises six divisions (PY eight divisions).

In the Engineered Components segment, the SFS Group partners with customers to develop and manufacture customer-specific precision-molded parts, assemblies and fastening solutions. Engineered Components serves the automotive, electronics and medical and industrial specials end markets. The Fastening Systems segment develops, manufactures and markets application-specific mechanical fastening systems for the construction industry. In the Distribution & Logistics segment, the SFS Group is a leading sales partner in Europe for direct and indirect materials in the areas of quality tools, fasteners and other C-parts as well as procurement solutions for customers in the industrial manufacturing sector.

The Board of Directors (BoD) and Group Executive Board are supported in their management and supervisory functions by the corporate cross-functions Corporate Finance & IT (information technology, finance, controlling, tax, legal & compliance, corporate development and investor relations), Corporate HR & Communications (HR, communications and marketing) and Technology (technology and knowledge transfer, operations and business development).

The parent company of the SFS Group is SFS Group AG, domiciled in Heerbrugg, municipality of Widnau, Switzerland. It is incorporated under Swiss law and listed on the SIX Swiss Exchange AG under the Swiss Reporting Standard (security number 23.922.930, ISIN CH 023 922 930 2). Its share capital amounts to CHF 3,890,000 (PY CHF 3,890,000) and its market capitalization was CHF 4,885.8 million (PY CHF 4,053.4) as of December 31, 2024.

An overview of all affiliated companies in the scope of consolidation can be found in Section 5.2 of the appendix of the Financial Report. The scope of consolidation does not contain any other listed companies besides SFS Group AG.

Significant shareholders

The founding families of SFS Group AG, Huber and Stadler/Tschan, form an organized group according to Art. 12 of the Ordinance of the Swiss Financial Market Supervisory Authority on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading (FINMA Financial Market Infrastructure Ordinance, FinMIO-FINMA). As of December 31, 2024, this shareholder group held 53.08% (20,649,616 shares) of SFS Group shares (PY 53.01%, 20,619,177 shares). Detailed information about the group composition can be found here: Significant shareholders | Founding families , whereby it should be noted that the shareholding according to the disclosure notification of September 8, 2018, was lower and that a new disclosure notification was published after the balance sheet date (December 31, 2024) on February 14, 2025: Significant shareholders | Founding families.

Both families have defined their principles of cooperation and partnership in a pool agreement. It is their intention to retain a majority of more than 50% of the capital and the voting rights in the long run. They agree with each other on important decisions and always put the successful development of the SFS Group before the particular interests of the families.

In the context of the acquisition of Hoffmann SE, a group in the sense of Art. 12 of the FinMIO-FINMA was established by the former owners of Hoffman SE in 2021. The purpose of this group, consisting of First SALT Stiftung and First ELF Stiftung which were established by the former owners of Hoffmann SE, was the future acquisition of shares in SFS Group AG in the light of the acquisition and the associated obligation to not sell the acquired SFS shares for a specific period of time (lock-up obligation). Since the lock-up obligation is still valid at the end of the reporting year, this group still exists. This shareholder group under the name “First SALT Stiftung/First ELF Stiftung” holds 4.11% (1,600,000 shares) of the shares in SFS Group AG as per the last notification to the SIX Swiss Exchange (PY 4.11%, 1,600,000 shares). Detailed information about this notice can be found here: Significant shareholders | First SALT Stiftung/First ELF Stiftung

As per the last notification to the SIX Swiss Exchange, UBS Fund Management (Switzerland) AG holds 5.75% of the shares in SFS Group AG (PY 3.01%). The company is not aware of any other disclosure notifications. Detailed information about this notice can be found here: Significant shareholders | UBS Fund Management (Switzerland) AG

SFS Group AG holds treasury shares to the extent of 0.09% (PY 0.03%).

Disclosure notifications pertaining to changes in shareholdings during the business year under review are published on the electronic publication platform of SIX Swiss Exchange AG. The notifications can be accessed via the following web link to the database search page of the disclosure office: Significant shareholders.

Cross-shareholdings

No cross-shareholdings of capital or voting rights exist with any other company.