Management Report

Stable positioning

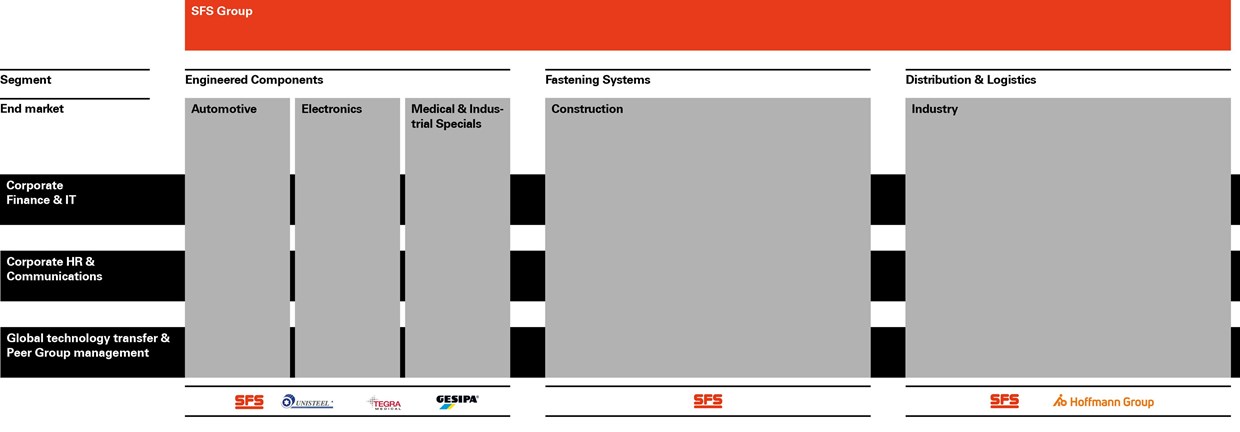

The 2024 financial year saw the SFS Group operating in a challenging economic environment characterized by uneven business performance and ongoing inventory destocking in individual end markets. With sales of CHF 3,039.0 million, an EBIT margin of 11.6% and major progress in the area of sustainability, the Group achieved most of its targets. SFS is in a robust and good position to meet the current economic challenges and any opportunities that arise.

_width-1240.jpeg)

Dear Shareholders,

The challenging environment of the first half of 2024 improved to a lesser degree than expected in the second half of the year. Global economic momentum fell short of expectations throughout the entire reporting period, primarily due to geopolitical tensions and economic uncertainties that resulted in lower rates of investment on the international stage as well as subdued demand.

The challenging environment impacted the results of SFS’s individual business areas to varying degrees. While all divisions of the Engineered Components (EC) segment improved over the previous year, the repercussions were clearly felt in the Fastening Systems (FS) segment and in the Distribution & Logistics (D&L) segment. In the FS segment, an improved market environment started to emerge in the fourth quarter of 2024 with slowly recovering demand.

The ongoing appreciation of the Swiss franc continued to put strong demands on our Swiss production sites, to prevent profitability from eroding with productivity boosting measures.

The SFS Group was still able to achieve most of its financial targets thanks to its broad positioning across different end markets and regions. The substantial investments of the past years in the realization of growth projects proved effective and made a vital contribution toward the overall result. The local-for-local strategy establishes a foundation for systematically and sustainably seizing any opportunities that arise due to changes in the environment and framework conditions.

SFS generated third-party sales of CHF 3,039.0 million and organic growth of 0.1% in the 2024 financial year. Persistently strong negative currency effects impacted the result by –1.9%. Overall, this results in a sales decline of –1.7% compared to 2023.

Consistent financial performance

Mix effects, lower utilization of production capacities in the FS and D&L segments, a cost base that remains elevated due to inflation, and the ongoing appreciation of the Swiss franc all had an impact on profitability. The EC segment’s positive development of the first half of 2024 continued in the second half of the year. Operating profit (EBIT) came to CHF 350.2 million (PY CHF 358.6 million) and the resulting EBIT margin to 11.6% (PY 11.7%) in the period under review. At CHF 242.7 million (PY CHF 268.5 million), net income amounted to 8.0% of net sales. The SFS Group achieved an operating free cash flow of CHF 226.1 million (PY CHF 139.4 million) in the 2024 financial year.

Earnings per share (EPS) of CHF 6.21 (PY CHF 6.84) were burdened by the economic environment as well as currency and tax effects. The equity ratio stood at an encouraging 59.7% at the end of the year under review.

The completion of several projects brought a substantial year-over-year reduction in growth-related expenditure on plant, equipment, hardware and software, which amounted to CHF 148.9 million in the reporting period (PY CHF 174.0 million). This continued to be driven by the equipment of the new production facility in Heerbrugg (Switzerland), the expansion of the production platform in Nantong (China) and the successful switch to S/4HANA, the new-generation ERP system.

The increased expenditure on research and development was mainly driven by the continued development and ramp-up of key projects and amounted to CHF 76.0 million (PY CHF 60.8 million). It was charged in full to the income statement for the period.

SFS made meaningful progress in the three areas of sustainability – environmental, social and governance – in the year under review.

Environment: On track to achieve targets, transparency in the supply chain increased

In 2024, the SFS Group reduced its Scope 1 and 2 greenhouse gas emissions by –38.8%. Compared to the 2020 reference year, this equates to a reduction of −74.6% in tons of CO₂ equivalents per value-added franc. This means that SFS has made significant progress toward achieving its target of reducing direct emissions by at least 90% by 2030. Scope 3 emissions were recorded in full for the first time and were reduced slightly on a like-for-like basis versus the previous year. The share of renewable electricity rose considerably to 75.2%. This means that SFS has already exceeded its target of drawing half of its power requirements from renewable sources by 2025. Vital progress has also been made in the management of the supply chain: The number of suppliers that have been assessed on the basis of environmental and social criteria has risen by approximately 74%.

Social: Talent development expanded, accident rate slightly higher

Over the past year, the SFS Group has increased the percentage of permanent employees enrolled in dual education and training programs worldwide to 6.3% (PY 5.1%). With an 11.2% year-on-year increase in part-time employees, SFS also made improvements in the area of working time flexibility. The accident rate stood at 4.1 accidents per million working hours (PY 4.0). With the “Vision Zero” initiative launched in 2024, SFS is making great efforts to reduce the accident rate for the long term.

Governance: Responsibility embraced, due diligence obligations fulfilled

There were once again no compliance violations that resulted in fines or legal proceedings in the year under review. Furthermore, SFS has no knowledge of any human rights violations that were committed within the company’s sphere of influence in 2024. This also includes the topic of child labor. The Code of Conduct, which is applicable to all employees, was updated in the year under review. The SFS Group continued to roll out the Supplier Code of Conduct, which has been mandatory since 2024, and will also integrate it into the Terms and Conditions of Purchase in 2025.

Organizational development to strengthen the customer focus

To strengthen the focus on selected end markets, make systematic use of potential arising through the inclusion of Hoffmann and intensify collaboration even further, the FS and D&L segments were newly organized as at January 1, 2025:

- The D&L segment was made up of two distinct divisions – D&L Switzerland and D&L International – until the end of 2024. To better leverage the cross-selling potential that exists between tools, fastening systems and procurement solutions, the two divisions were disbanded and merged to form the D&L segment. The segment will now focus fully on the trading business with customers in industrial manufacturing. The Construction & Wood business area of the D&L Switzerland division that is focused on customers in the construction industry was allocated to the FS segment from January 1, 2025, onward. Martin Reichenecker will lead the D&L segment.

- The FS segment has solely consisted of the Construction division since January 1, 2024. This division was also disbanded and transferred to the FS segment as of January 1, 2025. This change will enable SFS to further sharpen the FS segment’s end-market-specific focus. It will be headed up by Thomas Jung, who previously served as Head of the Construction division.

- Iso Raunjak, previously Head of the D&L Switzerland division, took on the position of Chief Human Resources Officer (CHRO) at the start of 2025, giving him responsibility for Human Resources (HR), Marketing & Corporate Communications and ESG (Environment, Social and Governance).

13,689 Value Creators

The SFS Group had 13,689 employees (FTE, PY 13,198) as at December 31, 2024.

Potential risks evaluated

The Group Executive Board and the Board of Directors assess the main business risks to which SFS Group is exposed on a regular basis. A comprehensive risk assessment is conducted at least once a year in which the relevant risks are systematically classified according to the likelihood of occurrence and the severity of the potential consequences. Accordingly, potential risks and ways to contain them were also discussed during the year under review. The focus was on to the dependency of the global economic environment and geographic shifts in demand; currency fluctuations; geopolitical instabilities; data breaches and business interruptions due to cyber attacks; disinformation, natural disasters; the impact of failing to meet the sustainability targets set; and increasing regulatory requirements in the area of supply chains and tax.

Changes in the Group Executive Board

Iso Raunjak, previously head of the D&L Switzerland division, replaced Arthur Blank as CHRO as at January 1, 2025. Arthur Blank has been working at SFS since 1982 and stood at the helm of the Construction division from 2014 to 2023. He took charge of Corporate HR & Communications on an interim basis at the start of 2024. At the end of 2024, he stepped down from the Group Executive Board but will continue to support SFS in the area of talent management. The Board of Directors and Group Executive Board would like to thank Arthur Blank for his loyalty and all his successful efforts over these many years in a variety of management positions.

Changes in the Board of Directors

Shareholders elected Tanja Birner to the Board of Directors as a member at the Annual General Meeting on April 24, 2024.

Looking ahead to the 32nd Annual General Meeting on April 30, 2025

The next Annual General Meeting of SFS Group AG will be held at Sportzentrum Aegeten in Widnau (Switzerland) on April 30, 2025.

In view of the stable earnings situation, the Board of Directors proposes that a dividend of CHF 2.50 (PY CHF 2.50) per share be distributed. Half of it shall be distributed from retained earnings and half of it from the statutory capital reserve.

Further information will follow together with the invitation, which will be sent out in March 2025.

Outlook for the 2025 financial year

The outlook continues to be shaped by considerable uncertainty. Placing the highest possible focus on customers, pushing further ahead the innovation projects and ensuring efficient and profitable business processes retain top priority in this volatile environment.

For the financial year 2025, SFS expects an EBIT margin around previous year level.

Thank you

We would like to express our most heartfelt gratitude to all employees of the SFS Group, whose motivation, efforts, expertise and great innovative spirit made SFS’s successful development possible in the year under review.

Our thanks also go out to our business partners for the consistently constructive collaboration. The trust they place in us lays the foundation for our work together to develop solutions that generate lasting added value.

We would also like to thank our shareholders for their loyalty and their trust in SFS. They lend the SFS Group stability, thereby contributing to the company’s sustainable development.

_width-1240.jpeg)

Thomas Oetterli

Chair of the Board of Directors

Jens Breu

CEO